ATO’s ominous “data matching” letters, what to do if you get one!

Australian taxpayers unlucky enough to receive one of the ATO’s ominous “data matching” letters this year are being urged to act quickly or face being thousands of dollars worse off.

The tax man uses sophisticated technology to sift through mountains of data from third-party institutions such as banks to sniff out whether any information, such as sales of shares or property, has been left off a tax return — and the number of Aussies receiving these “please explain” letters is growing every year.

It’s all part of the ATO’s push to raise more than $1 billion in revenue by cracking down on dodgy claims, according to Etax, which warns that once you get the letter in the mail, the clock is ticking.

“What it means is the taxpayer has lodged a return either current or up to two years ago, and now the ATO has done some data-matching with third parties and decided that something on the return is incorrect so they send out a letter,” said Etax senior tax agent Liz Russell.

“Once you get that, quite often people can freak out or get concerned, they might stick it in their drawer and hope it goes away. But if you don’t address is within the time frame, usually 28 days, the ATO will raise an amended assessment based on the information they believe to be correct and in some cases, issue a penalty for overpaid refunds.”

Ms Russell said with more institutions now handing over information, the ATO has been going back through previous years’ tax returns for which data was previously not available. Typically the data relates to sale of capital assets.

“I’ve seen them go back four years,” she said. “It doesn’t have a lot to do with deductions because deductions aren’t things they can data match. It’s things like dividends, shares, sale of rental properties, missing PAYG summaries.”

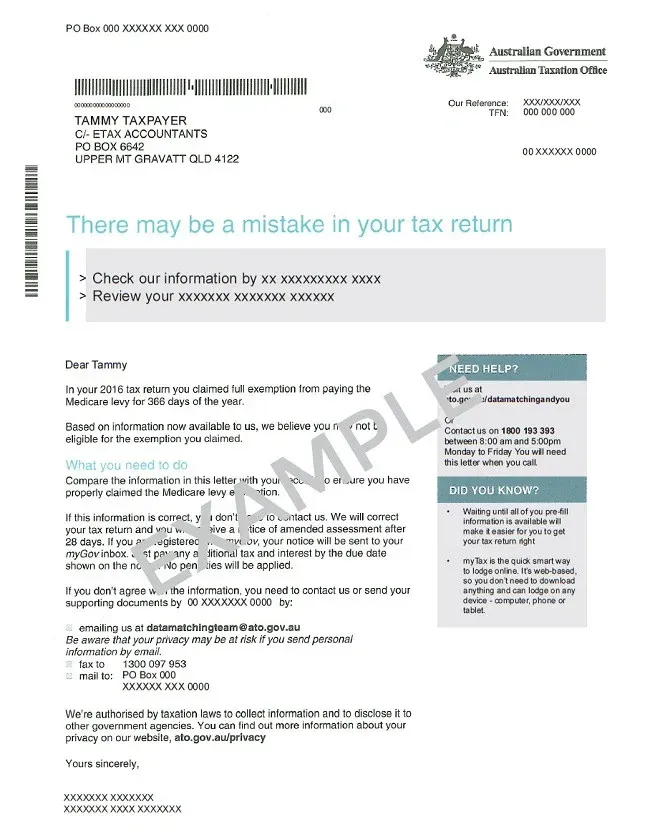

Above is an example of an ATO data-matching letter.

Ms Russell said she had seen “a whole pile recently where people disposed of shares but didn’t declare it on their return” for that year. The danger for taxpayers is if they don’t provide the full picture to the ATO, it will assume the entire sale price was a profit.

“If I sold them for $5000, the ATO is going to assess me on $5000, even if I bought them for $6000 and made a loss,” she said. “Sticking your head in the sand or sticking the letter in the drawer is the worst thing to do.”

If the taxpayer is unable to substantiate the flagged income or deduction claims, the ATO will determine whether or not to impose a financial penalty based on whether it thinks the taxpayer took reasonable care when completing their original tax return.

Penalties are calculated depending on the severity of the mistake. Failure to take reasonable care results in a penalty of 25 per cent of the amount owed, recklessness is a penalty of 50 per cent of the amount owed, and intentional disregard is a penalty of 75 per cent of the amount owed.

Ms Russell said often very minor mistakes wouldn’t incur a penalty, but if it resulted in a higher refund than the taxpayer was entitled to they may be required to pay back the excess amount and potentially interest.

An ATO spokeswoman said all individual income tax returns were “automatically risk assessed” and that more than 99,000 tax returns had already been adjusted due to “simple errors and omissions” since July 1.

“Where there is significant risk, or an error or omission is identified, the return is stopped and where appropriate the return may be adjusted to avoid an incorrect refund being paid to a client that may have resulted in future debt,” she said.

“For example, where we have third-party data reported to the ATO that does not match what was declared in the tax return we will correct the return before issuing the refund for the client.”

In addition to these adjustments, “our audit program continues throughout the year, meaning that whilst we may not review all claims in detail at tax time, where we identify claims that are outside the norm, the ATO will contact people later to review the claims made and request substantiation where necessary”.

“Our strategies focus on claims that appear high, for example claims that are high in comparison to other people in the same profession at the same income level,” she said.

“For taxpayers who have a legitimate claim, the best approach is to ensure they keep records to support their claim. The myDeductions tool in the ATO app makes it easy to store a photo of receipts so that it’s easy to have on hand when needed.”

The ATO has received more than 5.9 million lodgements, an 18 per cent increase — more than 800,000 — compared with this time last year.

“We have issued over 3.9 million individual 2019 income tax refunds with a total value of over $9.7 billion,” the spokeswoman said.

Article: TCM