How to cash in on Direct Debit for Small Business

Technology has made direct debit for small business far easier and more affordable. Now you don’t have to wait for customers to approve and pay your invoice. Learn how it works.

What is direct debit?

When you set up a direct debit with a customer, you can collect payments straight from their bank. Of course you have to notify them ahead of time what you’re taking and when, but the customer doesn’t have to do anything to make the payment happen.

Benefits of direct debit for small business

While it takes 30 days or more for a customer to pay an invoice, direct debit is almost instant. Payment is triggered as soon as you send the bill.

It’s convenient, too. Customers don’t have to approve payments or remember to make payments, which simplifies their life. And you don’t have to spend as much time tracking invoices or chasing payments. Businesses that use direct debit to bill customers say they get back a day a week in admin time (this is an average, and would obviously change depending on size).

Direct debit is ideal for:

- subscriptions for things like gym memberships or software

- regular invoices such as monthly retainers (for fixed or variable amounts)

- accepting instalments to help customers spread out their costs

- collecting rent from tenants

How does direct debit work?

Your customer fills out a direct debit form (also known as a mandate) authorising you to take payments from their bank. When a payment is coming up, you send the customer a notice saying how much will be taken, and when. The customer doesn’t need to take any other action. When the due date comes, the payment is made automatically.

How long does a direct debit take?

Customer payments can take up to five working days to clear. The transfer isn’t quite as fast as other online payment methods because you’re pulling money from their account. That’s a slower process than if they push the money to yours.

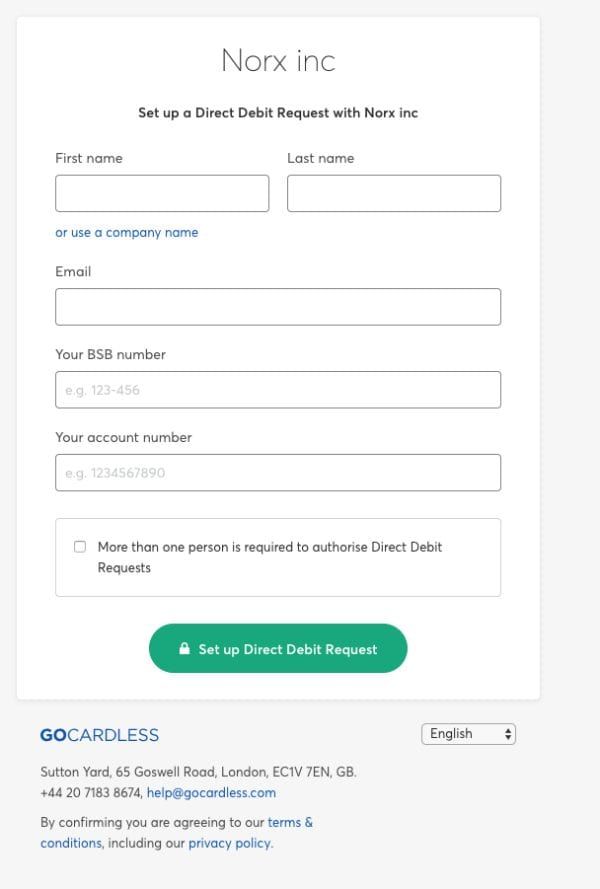

What does a direct debit form look like?

A direct debit form can be filled out online or on paper. Here’s what they look like:

Direct debit collection options

You can take one of two approaches to direct debit.

- Set it up directly through your bank

This can be easy or hard depending on where your customers reside. It’s a lengthy negotiation in some countries. - Use a direct debit provider

The levels of service and charges can vary a lot so shop around.

Easy direct debit for small business

Direct debit was first used by Unilever in the 1960s, but it was complex and expensive. And that’s the way it stayed for a long time. Online technologies have recently streamlined the process, making it affordable for smaller businesses.

As a result, you can now set up for free, and direct debit a customer for between 20 cents and $2 per transaction.

How to set up direct debit

If you’re a small business, you’re probably going to start with an off-the-shelf provider. Here’s how it works.

- Choose your direct debit provider

Set up your account through their website (or through your online accounting software). - Add customers and invite them to pay through direct debit

They’ll be emailed a direct debit form. Once they fill it out, you can take payments from their bank. - Set up your payments

You can use it to collect recurring or one-off bills. - Your customer is automatically notified before a payment is collected

The notice period is regulated so make sure your provider complies. - Payment clears in your account – minus the provider’s fee

The fee will depend on the size of the bill but shouldn’t go higher than about $2.

Manage all your payments online

View and manage all of your direct debit accounts online. If you’ve chosen a system that talks to your accounting software, you can reconcile payments online too.

What about direct debit indemnity?

Customers have the right to cancel a direct debit transaction and receive a refund. The rules around this vary from market to market so, again, it depends where your customers are based. But it can be hard to avoid giving a refund when one is requested, even if you disagree with it. That’s why direct debit is not recommended for really big transactions

Fortunately, only about 1 in 500 direct debit transactions gets disputed.

Direct debit services for small businesses

While a lot of companies offer online payment services like credit card, debit card and automated clearing house (ACH), there aren’t as many doing direct debit for small business just yet. That is changing, however, and there are still well-trusted options out there.

GoCardless and Ezidebit are respected operators that integrate with popular online accounting software.